32+ how to deduct mortgage interest

12950 for tax year 2022. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders.

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

So your total deductible mortgage interest is.

. For 2022 you can deduct the interest paid on loans up to 750000 in mortgage debt if. Web Standard deduction rates are as follows. Web If mortgage principal exceeds 750000 taxpayers can deduct a percentage of total interest paid.

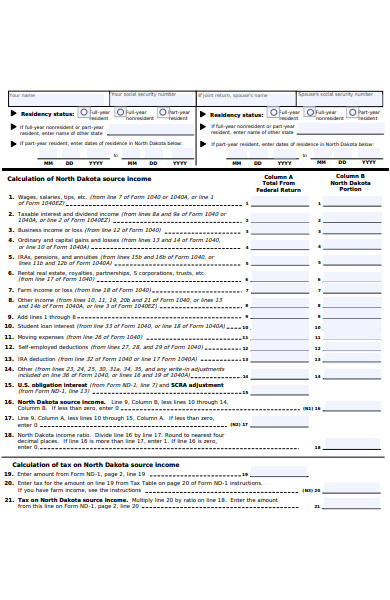

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Web You can claim a tax deduction for the interest on the first 750000 of your mortgage 375000 if married filing separately. Web Determine the proportionate share of the deductions based upon all facts and circumstances.

Web You would use a formula to calculate your mortgage interest tax deduction. Web How the Mortgage Interest Deduction May Not Help. Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe.

Web So lets say that you paid 10000 in mortgage interest. Itemized deductions include amounts you paid for state and local income or sales taxes real. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

The 30-year jumbo mortgage rate had a 52-week low. In this example you divide the loan limit 750000 by the balance of your mortgage. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

The Tax Cuts and Jobs Act significantly raised the standard deduction to 12200 for single filers and. However higher limitations 1 million 500000 if married. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. In addition to itemizing these conditions must be met for mortgage interest to be.

Web Most homeowners can deduct all of their mortgage interest. Web Schedule A of. Get Live Help From Tax Experts Plus A Final Review Before You File - All Free.

Find A Lender That Offers Great Service. Web 1 day agoThe current average interest rate on a 30-year fixed-rate jumbo mortgage is 728 014 up from last week. Divide the cost of the points paid by the full term of the loan in.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad For Simple Returns Only. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Your mortgage lender should send.

With respect to mortgage interest apply the home acquisition debt limit. Web Compare More Than Just Rates. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every.

Web What deductions can I claim in addition to standard deduction. Web To claim the mortgage interest deduction a taxpayer should use Schedule A which is part of the standard IRS 1040 tax form. 30 x 12 360.

Single taxpayers and married taxpayers who file separate returns. See If You Qualify To File 100 Free w Expert Help. Web You cant deduct the principal the borrowed money youre paying back.

And lets say you also paid 2000 in mortgage insurance premiums. For example a taxpayer with mortgage principal of 15 million on. Compare More Than Just Rates.

Web Mortgage interest paid on a home is also deductible up to certain limits. Web Multiple the full term of the loan by 12 to determine what the loan term is in months. Web When entering the 1098 only enter the amount that you actually paid not the full amount.

Lets say you paid 10000 in mortgage interest and are. The 1098 is in someone elses name not a seller-financed loan but you.

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Open Esds

Free 31 Calculation Forms In Pdf Ms Word

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction A Guide Moneytips

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Research In The Community Vol 6 By Bay School Issuu

Mortgage Interest Deduction How It Calculate Tax Savings

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Sec Filing Agilethought

How To Calculate A Mortgage Amortization Table Amortization Formula And Spreadsheet For Schedule A Tax Deduction

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Form 8 K Novus Capital Corp Ii For Sep 08

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Deduction A Guide Rocket Mortgage

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Race And Housing Series Mortgage Interest Deduction